1QFY2020 Result Update | Media

August 13, 2019

TV Today Network

BUY

CMP

`313

Performance Update

Target Price

`456

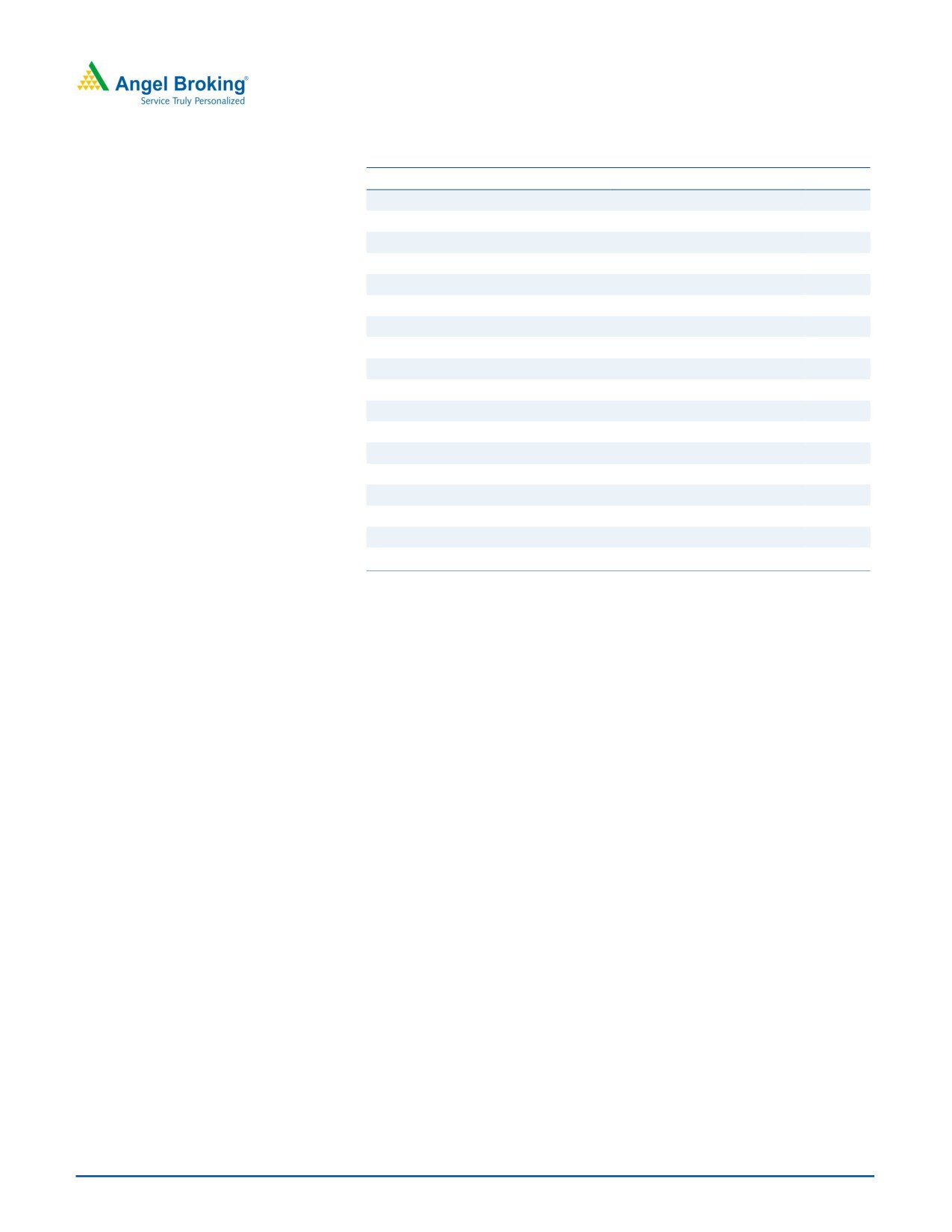

Y/E March (` cr)

1QFY20

1QFY19

% yoy 4QFY19

% qoq

Investment Period

12 Months

Net sales

245

188

30.2

175

40

EBITDA

74

62

19.2

33

129

Stock Info

EBITDA margin (%)

30.4

33.2

(279bp)

18.6

1,175bp

Sector

Media

Adjusted PAT

51

40

27.3

24

116

Market Cap (` cr)

1,873

Source: Company, Angel Research

Net Debt (` cr)

292

For 1QFY2020, TV Today Network Ltd (TTNL) posted results above our

expectations on both top-line as well as bottom-line fronts. Revenue grew by

Beta

1.1

~30% yoy to `245cr due to strong ad revenue growth. On the operating front,

52 Week High / Low

467/237

margins contracted by 279bps yoy. However, PAT grew ~27% yoy to `51cr.

Avg. Daily Volume

4,171

Higher ad spends boosted the overall top-line growth: The company’s top-line

grew by 30% yoy to `245cr due to strong ad revenue growth (up ~31% yoy to

Face Value (`)

5

`208cr). Other segment grew by ~62% to `28cr. However, the company has

BSE Sensex

36,436

reported de- growth in radio segment (`4cr vs. ~`6cr in 1QFY2019).

Nifty

11,071

Strong PAT growth driven by robust top-line: On the operating front, margins

Reuters Code

TVTO.BO

contracted by 279bps yoy. However, PAT grew ~27% yoy to `51cr. Segment

wise, advertisement business witnessed EBIT margin contraction of 506bps yoy.

Bloomberg Code

TVTN.IN

Further, radio business reported EBIT level loss of `4cr yoy vs. `1cr (loss) in

1QFY2019.

Outlook and Valuation: Going forward, we expect TTNL to report net revenue

Shareholding Pattern (%)

CAGR of ~14% over FY2019-21E to ~`962cr and net profit CAGR of ~12%

Promoters

58.0

over the same period to `170cr on the back of leadership position in Hindi

news genre and upcoming elections. TTNL is a debt free company with decent

MF / Banks / Indian Fls

15.0

cash on balance sheet. At the current market price of `313, the stock trades at

a PE of 12.1x and 11.0x its FY2020E and FY2021E EPS of `25.8 and `28.5

FII / NRIs / OCBs

10.8

respectively. We recommend BUY on TTNL with a Target Price of `456.

Indian Public / Others

16.2

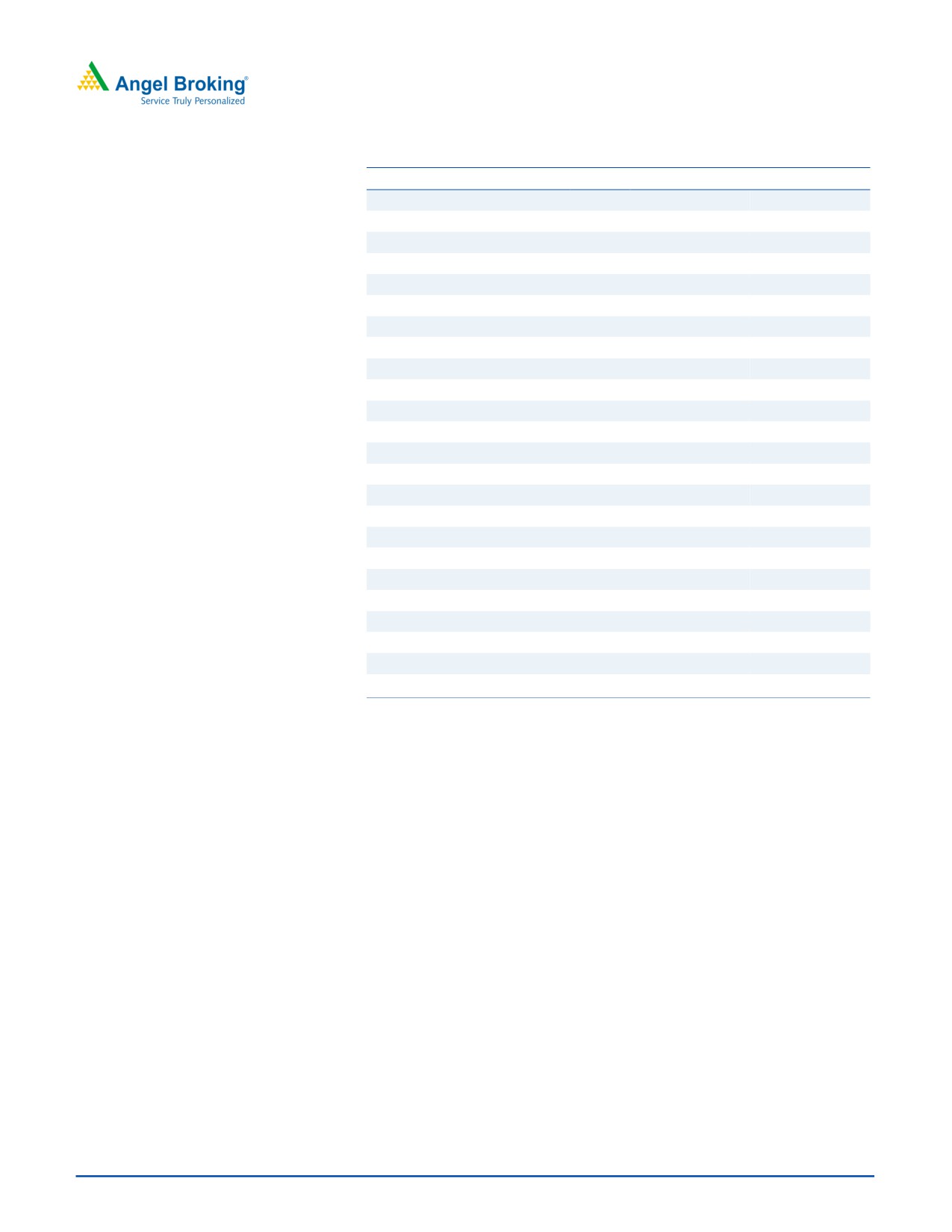

Key financials

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

Abs. (%)

3m 1yr

3yr

Net sales

721

742

880

962

Sensex

0.1

(1.2)

33.8

% chg

10.5

3.0

18.5

9.3

Net profit

119

131

154

170

TTNL

3.9

(29)

5.2

% chg

34.7

2.5

17.5

10.2

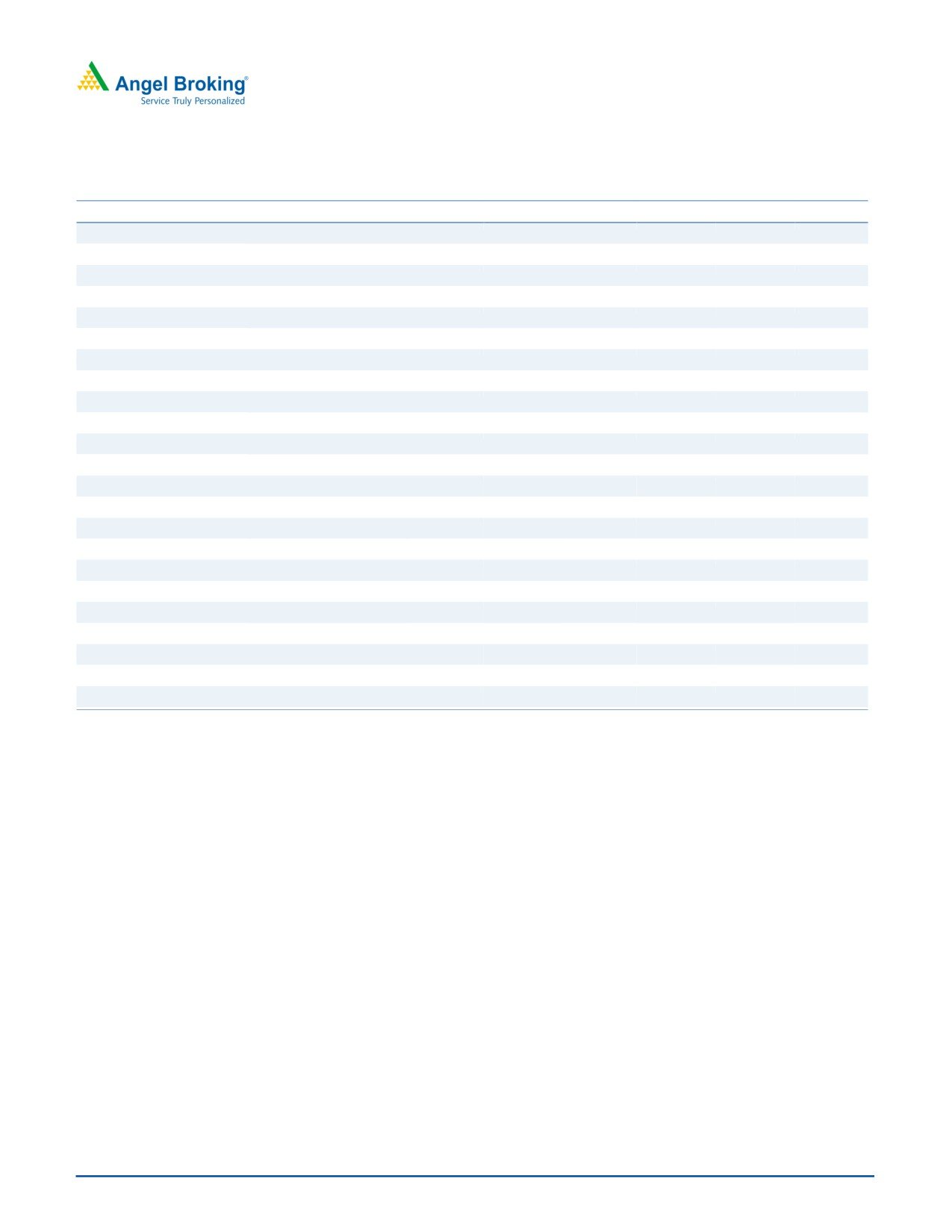

3-year price chart

EBITDA margin (%)

26.9

26.9

27.6

28.0

EPS (`)

21.4

22.0

25.8

28.5

600

P/E (x)

14.6

14.2

12.1

11.0

500

P/BV (x)

2.8

2.4

2.5

3.3

400

RoE (%)

18.0

16.9

20.3

29.8

300

RoCE (%)

24.5

21.5

26.8

39.6

200

EV/Sales (x)

2.3

2.1

1.8

1.9

100

EV/EBITDA (x)

8.6

7.9

6.7

6.8

0

Source: Company, Angel Research, Note: CMP as of February 13, 2019

Source: Company, Angel Research

Amarjeet S Maurya

022-39357800 Ext: 6831

Please refer to important disclosures at the end of this report

1

TV Today Network | 1QFY2020 Result Update

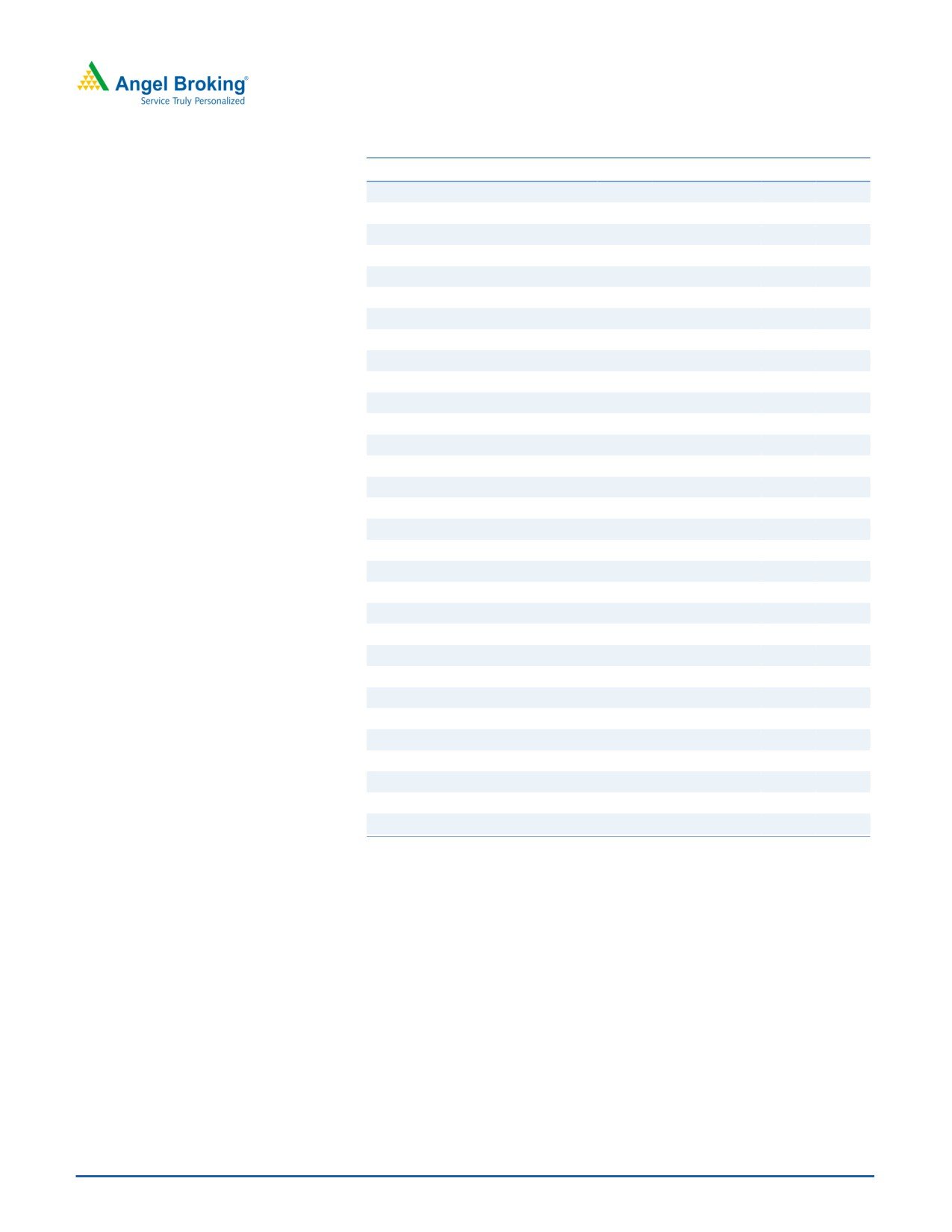

Exhibit 1: 1QFY2020 Performance

Y/E March (` cr)

1QFY20

1QFY19

% yoy

4QFY19

% qoq

FY2020

FY2019

% chg

Net Sales

245

188

30.2

175

40.2

739

691

6.9

Staff Costs

66

55

20.6

55

21.4

222

193

15.3

(% of Sales)

27.0

29.2

(214)

31.2

(419)

30.0

27.9

219

Other Expenses

104

71

47.2

88

19.1

319

302

5.5

(% of Sales)

42.6

37.7

493

50.2

(757)

43.1

43.7

(59)

Total Expenditure

171

126

35.6

142

20.0

541

495

9.3

Operating Profit

74

62

19.2

33

128.8

198

197

0.9

OPM

30.4

33.2

18.6

26.8

28.4

Interest

1

0

236.2

0

237.3

1

1

5.1

Depreciation

10

8

22.5

8

20.8

31.5

31.3

0.7

Other Income

14

7

97.5

15

(3.1)

36.7

23.4

56.5

PBT (excl. Ext Items)

78

62

27.2

39

100.1

203

188

7.8

Ext (Income)/Expense

-

-

-

-

PBT (incl. Ext Items)

78

62

27.2

39

100.1

203

188

7.8

(% of Sales)

32.0

32.7

22.4

27.4

27.2

Provision for Taxation

27

22

16

72.6

64.5

12.6

(% of PBT)

34.9

34.9

39.6

35.8

34.3

Reported PAT

51

40

27.3

24

115.6

130

123

5.3

PATM

20.8

21.3

13.5

17.6

17.9

Minority Interest After NP

Extra-ordinary Items

(14)

Reported PAT

51

40

27.3

24

115.6

130

137

(5.2)

PATM

20.8

21.3

13.5

17.6

19.8

Source: Company, Angel Research

August 13, 2019

2

TV Today Network | 1QFY2020 Result Update

Outlook and Valuation

Going forward, we expect TTNL to report net revenue CAGR of ~14% over

FY2019-21E to ~`962cr and net profit CAGR of ~12% over the same period

to `170cr on the back of leadership position in Hindi news genre and upcoming

elections. TTNL is a debt free company with decent cash on balance sheet. At

the current market price of `313, the stock trades at a PE of 12.1x and 11.0x its

FY2020E and FY2021E EPS of `25.8 and `28.5 respectively. We recommend

BUY on TTNL with a Target Price of `456.

Risks

1) Losing leadership position in viewership ranking could affect the company’s

advertisement revenue, and hence poses a downside risk to our estimates.

2)

Overall slowdown in the Indian economy could impact the advertisement

spends, which could be negative for TTNL.

3) Delay in digitalization could impact the company’s subscription revenue

growth.

Company Background

TV Today Network (TTNL) is one of the leading Indian Hindi and English news

television networks. The company's operating segments include television (TV)

broadcasting and radio broadcasting. The company operates four news channels,

which include Aaj Tak, India Today (earlier know as Headlines Today), TEZ and Dilli

Aaj Tak. The company is also engaged in publishing, and its publications include

India Today, Business Today, etc. Moreover, TTNL is associated with well know

anchors like Rajdeep Sardesai and Karan Thapar. Living Media India Limited is the

holding company of TTNL.

August 13, 2019

3

TV Today Network | 1QFY2020 Result Update

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2017

FY2018

FY2019

FY2020E FY2021E

Total operating income

652

721

742

880

962

% chg

12.2

10.5

3.0

18.5

9.3

Total Expenditure

490

527

543

637

693

Employee Cost

181

202

223

229

250

Selling & Administrative Expenses

-

-

-

-

-

Others Expenses

309

325

320

408

442

EBITDA

163

194

200

243

269

% chg

23.7

19.2

3.0

21.7

10.9

(% of Net Sales)

24.9

26.9

26.9

27.6

28.0

Depreciation& Amortisation

29

31

32

39

42

EBIT

134

162

168

204

228

% chg

33.0

21.5

3.5

21.4

11.5

(% of Net Sales)

20.5

22.5

22.6

23.2

23.7

Interest & other Charges

8

4

1

4

4

Other Income

29

25

37

30

30

(% of PBT)

19.0

13.5

18.0

13.0

11.8

Share in profit of Associates

-

-

-

-

-

Recurring PBT

155

183

204

230

254

% chg

34.8

18.6

11.2

12.8

10.2

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

155

183

204

230

254

Tax

54

64

73

76

84

(% of PBT)

35.0

35.1

35.7

33.0

33.0

PAT (reported)

100

119

131

154

170

Add: Share of earnings of associate

-

-

-

-

-

ADJ. PAT

100

119

131

154

170

% chg

21.5

34.7

2.5

17.5

10.2

(% of Net Sales)

15.4

16.5

17.7

17.5

17.7

Basic EPS (`)

15.9

21.4

22.0

25.8

28.5

Fully Diluted EPS (`)

15.9

21.4

22.0

25.8

28.5

% chg

21.5

34.7

2.5

17.5

10.2

August 13, 2019

4

TV Today Network | 1QFY2020 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2017

FY2018

FY2019

FY2020E FY2021E

SOURCES OF FUNDS

Equity Share Capital

30

30

30

30

31

Reserves& Surplus

540

632

748

729

539

Shareholders Funds

570

662

777

759

570

Total Loans

35

-

3

3

3

Deferred Tax Liability

8

11

14

14

14

Total Liabilities

613

673

794

786

596

APPLICATION OF FUNDS

Gross Block

257

343

362

403

433

Less: Acc. Depreciation

59

85

115

154

196

Net Block

199

258

247

249

237

Capital Work-in-Progress

3

2

4

4

4

Investments

6

-

0

-

-

Current Assets

525

560

684

707

569

Sundry Debtors

163

185

185

219

237

Cash

263

199

291

350

190

Loans & Advances

61

70

174

97

101

Other Assets

36

104

32

38

38

Current liabilities

143

173

173

205

246

Net Current Assets

382

387

511

502

323

Deferred Tax Asset

23

25

31

31

31

Mis. Exp. not written off

-

-

-

-

-

Total Assets

613

673

794

786

596

August 13, 2019

5

TV Today Network | 1QFY2020 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2017

FY2018

FY2019

FY2020E FY2021E

Profit before tax

153

183

204

230

254

Depreciation

29

31

32

39

42

Change in Working Capital

(98)

(1)

(112)

69

18

Interest / Dividend (Net)

(10)

(1)

(25)

4

4

Direct taxes paid

(59)

(63)

(77)

(76)

(84)

Others

(2)

7

8

-

-

Cash Flow from Operations

14

158

30

266

234

(Inc.)/ Dec. in Fixed Assets

4

(93)

(1)

(30)

(30)

(Inc.)/ Dec. in Investments

1

6

-

-

-

Cash Flow from Investing

3

(99)

(1)

(30)

(30)

Issue of Equity

-

-

0

-

-

Inc./(Dec.) in loans

0

-

-

-

-

Dividend Paid (Incl. Tax)

(10)

(12)

(13)

(173)

(360)

Others

86

(110)

76

(4)

(4)

Cash Flow from Financing

76

(122)

63

(177)

(364)

Inc./(Dec.) in Cash

93

(64)

91

59

(160)

Opening Cash balances

170

263

199

291

350

Closing Cash balances

263

199

291

350

190

Source: Company, Angel Research

August 13, 2019

6

TV Today Network | 1QFY2020 Result Update

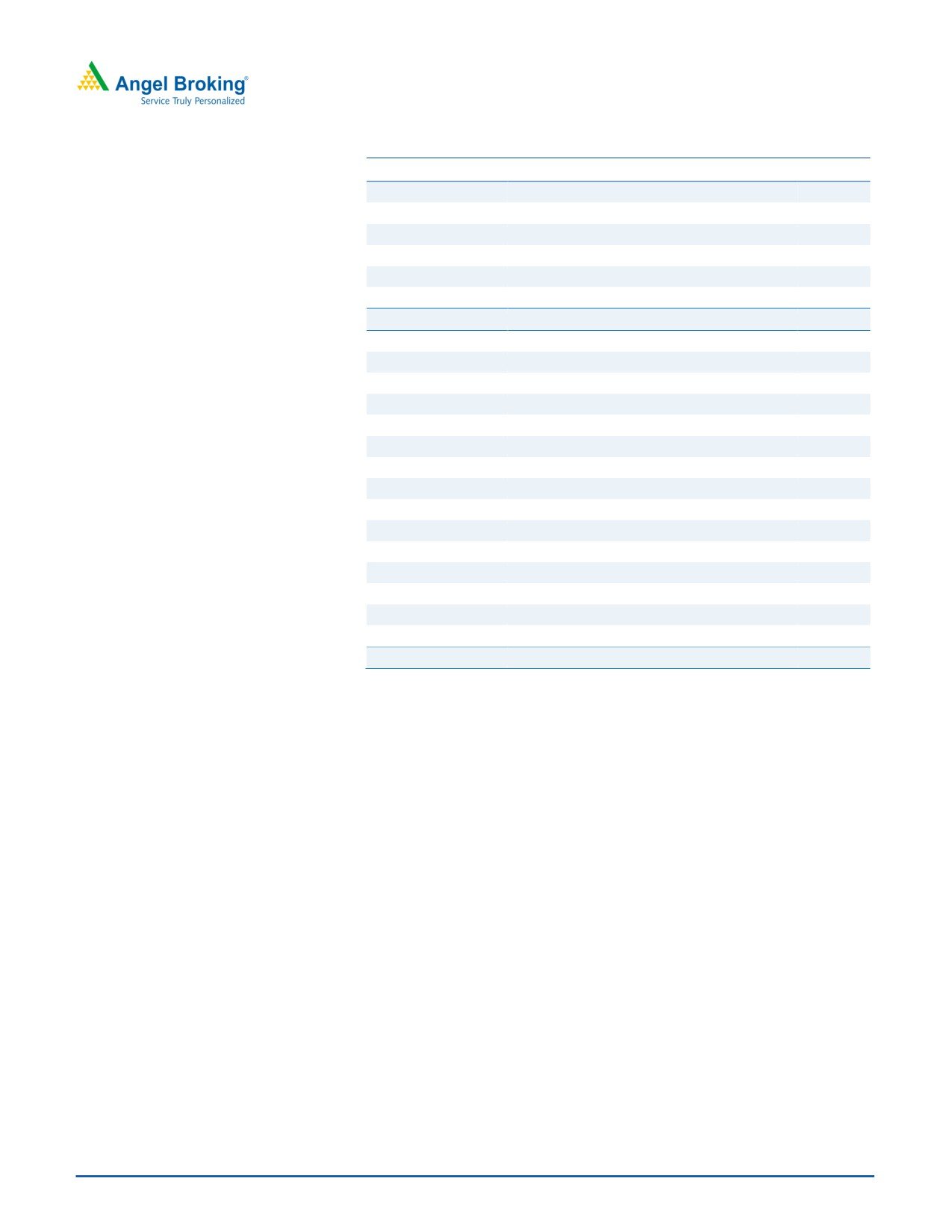

Key Ratios

Y/E March

FY2017

FY2018

FY2019

FY2020E FY2021E

Valuation Ratio (x)

P/E (on FDEPS)

19.7

14.6

14.2

12.1

11.0

P/CEPS

14.4

12.4

11.5

9.7

8.8

P/BV

3.3

2.8

2.4

2.5

3.3

Dividend yield (%)

0.6

0.8

0.8

9.2

19.3

EV/Sales

2.5

2.3

2.1

1.7

1.7

EV/EBITDA

10.0

8.6

7.9

6.3

6.2

EV / Total Assets

2.2

2.0

1.6

1.5

2.0

Per Share Data (Rs)

EPS (Basic)

15.9

21.4

22.0

25.8

28.5

EPS (fully diluted)

15.9

21.4

22.0

25.8

28.5

Cash EPS

21.7

25.2

27.3

32.3

35.5

DPS

1.9

2.6

2.6

28.9

60.4

Book Value

95.6

110.9

130.3

127.2

95.5

Returns (%)

ROCE

22.1

24.5

21.5

26.8

39.7

Angel ROIC (Pre-tax)

39.8

35.1

34.3

49.5

59.4

ROE

17.6

18.0

16.9

20.3

29.8

Turnover ratios (x)

Asset Turnover (Gross Block)

2.5

2.1

2.0

2.2

2.2

Inventory / Sales (days)

1

1

1

1

1

Receivables (days)

91

94

91

91

90

Payables (days)

49

44

41

41

44

Working capital cycle (ex-cash) (days)

44

50

51

51

47

Source: Company, Angel Research

August 13, 2019

7

TV Today Network | 1QFY2020 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

TV Today Network

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 13, 2019

8